College isn’t cheap, and trying to ace your exams while paying off your student loans and putting food on the table can feel like too much to juggle. Financial stress affects nearly 80% of college students who struggle with mental health issues over money.

Even for adults with a college degree and a steady career, financial stress has a major impact on every aspect of life. If you’re worried about being able to pay rent or having enough money to eat a decent meal, you likely won’t have the mental energy left to stay focused during hour-long lectures or to write a 5-page paper.

In some cases, financial stress can be so severe that you become exhausted, burnt out, depressed, or even drop out of school. Additionally, if you’re stressed about money, you may be more likely to delay getting health care or mental health treatment, opt for cheaper and faster foods, or skip out on getting a gym membership.

Financial stress in college students can also lead to unhealthy coping mechanisms – such as substance abuse, impulsive spending, or overeating. While these behaviors might let you escape your anxiety in the short term, they aren’t good for your physical or mental health and can increase stress in the long run.

Feeling overwhelmed by trying to handle all the things? We want to help you with all the things!!! Find a therapist near you who’s got your back.

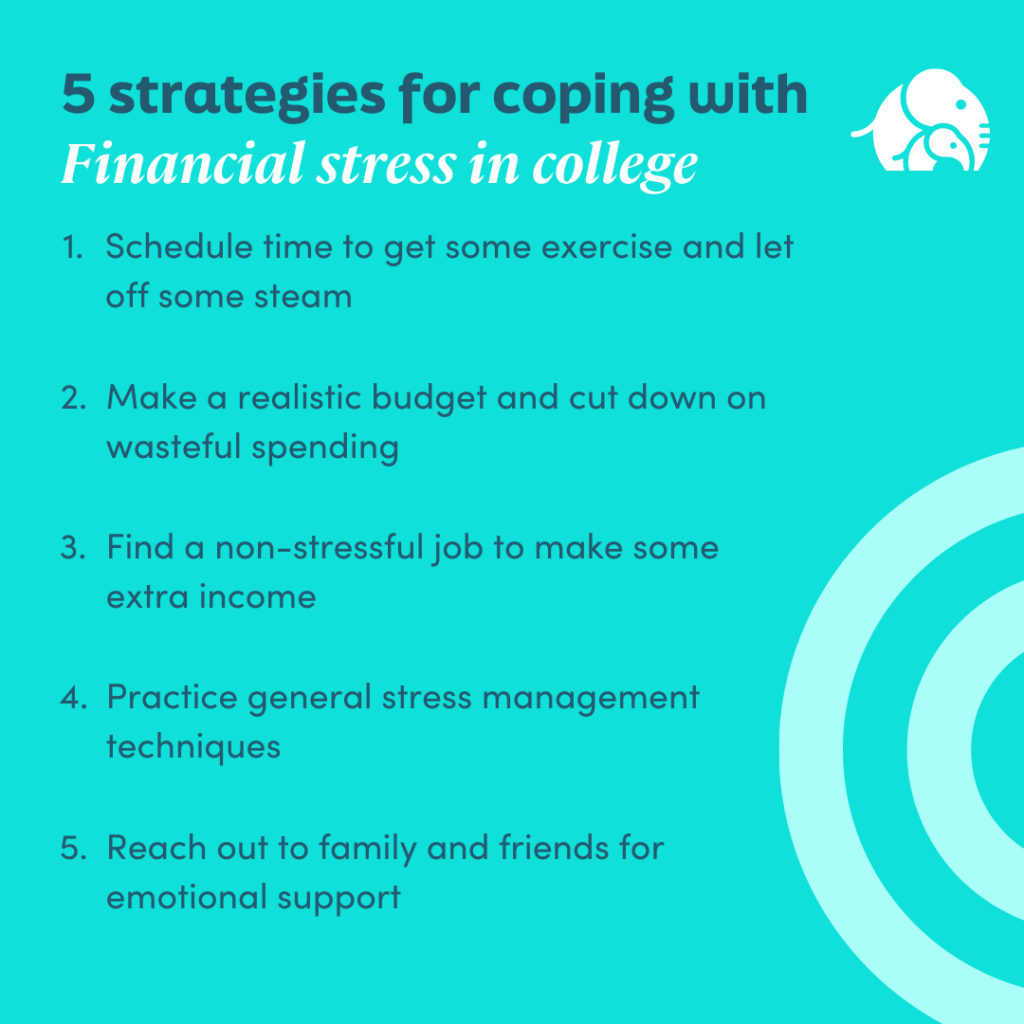

5 Coping Strategies for Dealing With Financial Stress in College

1. Create a Budget

Creating a budget is a practical way to help you feel more in control of your spending. Without a budget, you don’t see the big picture of your spending, and you might be more likely to make poor financial decisions which can contribute to more stress later down the road. Creating a plan for your weekly or monthly finances can minimize financial stress as you can better project your income and manage your expenses accordingly.

As you make your budget, here are a few guidelines to get started:

Cut Down on Wasteful Spending

If your finances are tight, a budget can show you areas where you can limit your spending and save more money. One way to do this is by making a list of all expenses and prioritizing each one. Look at the expenses at the bottom of the list – if any are unnecessary or excessive you can start by cutting that expense out.

Be Realistic and Flexible

Make sure your budget has enough flexibility that you reasonably stick to it. For example, make sure expenses like your monthly groceries and gas budget are actually enough to cover your food and travel. It’s also important to consider that unexpected events happen. What if your car breaks down and needs a tow? What if a friend wants to go catch a movie? If your budget is unrealistic and you can’t stick to it, you’re likely going to feel ashamed or even more stressed when you look at the numbers.

Set Long-Term Goals

If you want to boost your savings or save up for a trip or item you’ve wanted for a long time, a budget can help you get there. You simply need to figure out the total cost for the goal and how much room you have in your budget to set aside toward this goal each month.

2. Schedule Time for Physical Activity

Exercise is a natural and effective way to minimize stress in your life. Physical activity, especially aerobic exercises like swimming, cycling, or kickboxing, can help release tension in your body, improve your sleep, build your self-esteem, promote healthy breathing, and focus your mind on something other than your stress. Exercise has a positive effect on your body’s oxygen levels and blood flow. It also stimulates the production of endorphins, which naturally lift your mood and make you feel euphoric. Not to mention the many benefits regular exercise has on your physical health.

However, stress and a tight schedule can make finding the time and motivation to exercise difficult. By the end of the school day, you might feel so spent from the day’s activities and high-stress levels that the idea of working out seems impossible. And if you’re balancing a full school schedule and a job (not to mention spending time with family, friends, and pets which take up an important portion of your day) you might not know how to fit in a workout.

Fortunately, even just a few minutes of exercise can provide stress relief benefits. If you’re struggling to add an exercise routine to your busy schedule, it can help to start small. If you can only get a couple of minutes in, then start with that and build up. Find unique ways to naturally be more active. For example, you can take your bike to school instead of driving. You can use homework breaks to take a quick walk or do some yoga.

Remember, you don’t need to train like an athlete or bodybuilder to improve your health and see an improvement in your stress and mental health. If you typically spend a lot of time sitting, you’ll likely notice a shift in how you feel right away.

3. Find a Non-Stressful Job to Support Expenses

Working while going to school can be draining. If you’re not already working, getting a part-time job can help you make some extra income. If you already have a job, consider if the job you have now might be adding to your overall stress levels.

A full college class load can take the same energy, time, and stress as a full-time job. While finding a new job might not always be simple, if you’re already feeling like you’ve reached your limit, finding a job that’s more enjoyable and less stressful can help lighten the load. You can consider looking for a job on campus, which might make it easier to work shifts between classes and your bosses might be flexible in helping you find a schedule that leaves you enough time for homework.

4. Practice General Stress-Management Techniques

While increasing your income and starting a budget can help improve your financial situation and help you feel more in control, you might still find you consistently struggle with stress. Whether caused by your finances, school, unhealthy relationships, work, or a combination of all of these things, stress can have a harsh effect on your physical and mental health. Ongoing stress increases your heart rate, raises your blood pressure, causes headaches and digestive issues, disrupts your sleep, causes social withdrawal, makes you irritable, and affects your appetite.

Learning stress management skills and finding balance in your life is key to navigating difficult life situations – including financial difficulties. As we mentioned earlier, exercise is a great way to let off steam and decrease stress. Taking time to slow down and practice mindfulness decreases stress as well. Stretching, deep breathing, meditating, doing yoga, and practicing gratitude are all ways to slow down and refocus your mind. Other habits and techniques that may help limit stress include:

- Reducing caffeine intake, especially before bed

- Spending less time on social media

- Establishing a consistent sleep schedule

- Getting outside and soaking in some sunlight

- Accepting that some situations are out of your control

- Finding time throughout the week to do things you enjoy

- Spending more time with your loved ones

- Cooking and eating healthy meals

- Learning when to say no and not overfilling your schedule

- Getting your daily dose of laughter and fun

5. Reach Out to Family and Friends for Emotional Support

Feeling isolated in your struggles can make your stress even more intense. Reaching out to a friend when you’re overwhelmed can help you get your thoughts out and avoid rumination. Your friends and family can also help you put things in perspective and potentially provide helpful advice, showing you strategies that can help you better manage your finances and structure a less stressful life.

If you’re not used to sharing how you feel with others, it can be difficult to reach out the first couple of times. However, with practice, it gets easier, and you’ll learn who can turn to for support in times of need. Knowing you have people to turn to in times of stress can help you avoid negative coping behaviors. Rather than turn to alcohol or another bad habit in an attempt to work through your stress alone, you can take time to vent to a friend and build a support system you can rely on.

Feel like you’re forever climbing a mountain of stress? Find a therapist near you.